An Inside Look at the Financials of Private Schools: Financial Aid

May 10, 2023

This is the second of a two-part series discussing the finances of Poly and over 50 other non-profit high schools in New York through the lens of IRS Form 990 tax returns. Most data mentioned in this article should be available for you, the reader, to freely access on the “Charities and Nonprofits” page of the IRS website.

According to the IRS, during the 2019-2020 school year, Poly gave 229 students $9,072,653 of financial aid, at an average of $39,618.57 per student. Where does the money for financial aid come from? How is it distributed, and what exactly does it mean for an institution to meet 100 percent of students’ financial needs? Why does Poly give aid?

Overview of Financial Aid

The financial aid process begins with a family filing an application for aid, which contains financial information like assets, income, expenses, and debts. This part of the process can be challenging for some immigrant families as parents may not speak English as a first language and so they rely on their children to guide them through the process. Poly has improved in this aspect recently through the replacement of Tuition Aid Data Service with the Clarity Application, which simplifies the application process through integrations with the IRS. From this financial information, Poly is then able to calculate a student’s household contribution to education, which indicates how much Poly expects a student’s family to be able to pay. Because Poly meets 100 percent of demonstrated need, a student’s family has to pay only a household contribution to attend instead of full tuition; for an average 2019-2020 freshman on financial aid, for whom tuition cost $51,484, their household contribution would be approximately $11,865.43, according to the IRS.

One task the Board of Trustees and various committees deliberate on is affording financial aid for existing students while being able to financially assist newly admitted students. Associate Head of School Kyle Graham said that what decides this is a prediction of tuition revenue in the upcoming school year based on anticipated student enrollment and expected costs in the near and future terms; the financial aid office gets a slice of that predicted revenue to work with. “There’s always that conflict between wanting to spend more in one area versus wanting to spend more in another area. And I think that’s the Board’s job: at that 10,000-foot level, to help decide what are the priorities in the school,” he said.

Poly puts aside money for emergency aid for families whose financial situation takes a dramatic turn in the middle of the year; this aid was used a lot during COVID when suddenly many families found themselves unable to afford tuition, according to Graham.

Aside from tuition, financial aid at Poly helps to cover the costs of other parts of the Poly experience, including, “international and domestic travel, athletic trips, music lessons, one-on-one SAT prep and tutoring, college visits, summer academic courses, graphing calculators, and all technology devices,” according to Poly’s Financial Aid FAQs on the school’s website. Director of Enrollment Management and Financial Aid LaTasha Richards said she believes that non-tuition aid is an essential part of Poly, as during her time as a student at independent schools, not being able to participate in extracurriculars limited her experience.

When it comes to making financial aid at Poly happen, two people are crucial: Graham and Richards. Before coming to Poly in 2016, Graham held numerous college counseling and college admissions roles; he believes this dual perspective is what enables him to best serve the needs of students. “The process is very similar on both sides. And I felt really fortunate to be able to apply that knowledge and expertise to both parts of Poly,” he said. As Associate Head, Graham oversees financial aid at Poly and helps to devise the formulas that determine a student’s household contribution.

On the other hand, Richards, who previously held a decade-long career at Goldman Sachs and leadership roles in parents’ associations at other private schools, joined the Poly community as a parent; She volunteered for Admissions before being fully onboarded during the 2019-20 school year, earning her current title in 2021: “Through volunteering in the admissions office for a couple of years when I first came to Poly to…meet more people, that led me to running the Parents’ Association for a little bit and then ultimately an employment opportunity at Poly to be part of the admissions office.” Richards manages the budget for financial aid, both tuition and non-tuition, along with looking for new sources of funding for financial aid, such as working with the advancement office to get funding from alumni, and improving the application process for families.

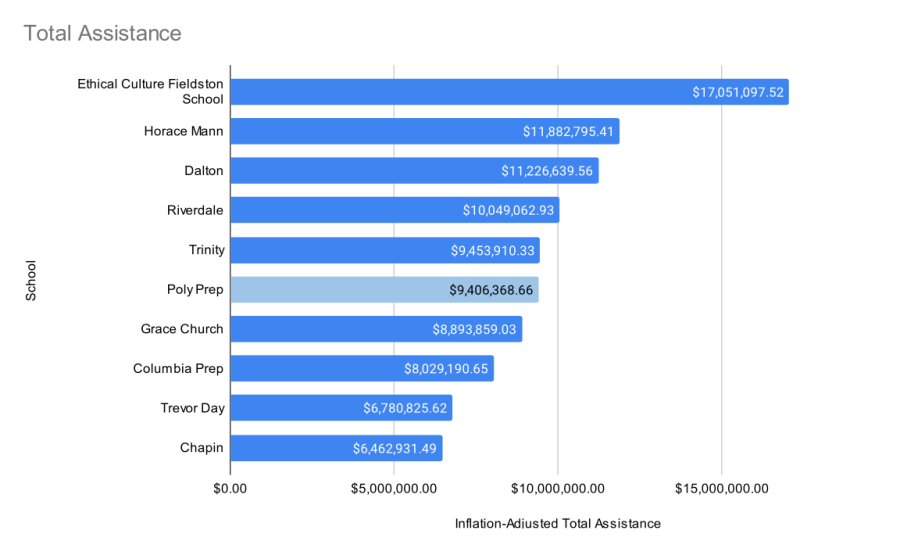

Charts

VERY BIG DISCLAIMER

Data for the “Total Assistance” and “Average Assistance Per Student” charts use data from 2019-20 Form 990s; all dollar amounts are in 2023 dollars.

Where possible these numbers include only tuition assistance for students who aren’t children of faculty; because there is no standard way of breaking down financial aid on the Form 990, it is at times ambiguous where money is coming from. For example, Poly’s listing for assistance includes tuition discounts for children of faculty.

When looking at the “Average Assistance Per Student” and “Average Assistance Per Recipient at Poly” charts, please keep the above in mind along with that tuition at private schools can differ in the tens of thousands of dollars, that tuition can vary from grade to grade, and that financial aid is always a balance between dollar amounts, the number of students on aid, and other resources such as emergency and extracurricular aid.

On the strange spike in average financial assistance seen in 2013-14 on the “Average Assistance Per Recipient at Poly,” Registrar Lori Redell had this to say to The Polygon: “When Sandy hit NYC in October of 2012, many Poly families were impacted in significant ways… Poly extended an invitation to siblings of Poly students who were displaced by the storm to attend Poly for the remainder of the school year tuition free. The students had been attending schools that had closed because of the storm. It is very likely that our business director counted the tuition not charged to these students as financial aid, thus causing the spike in [the] number of students and the drop in average award. No financial aid student at Poly received any less as a result of Sandy, but the additional students caused the bumps you are seeing in the graphs.”